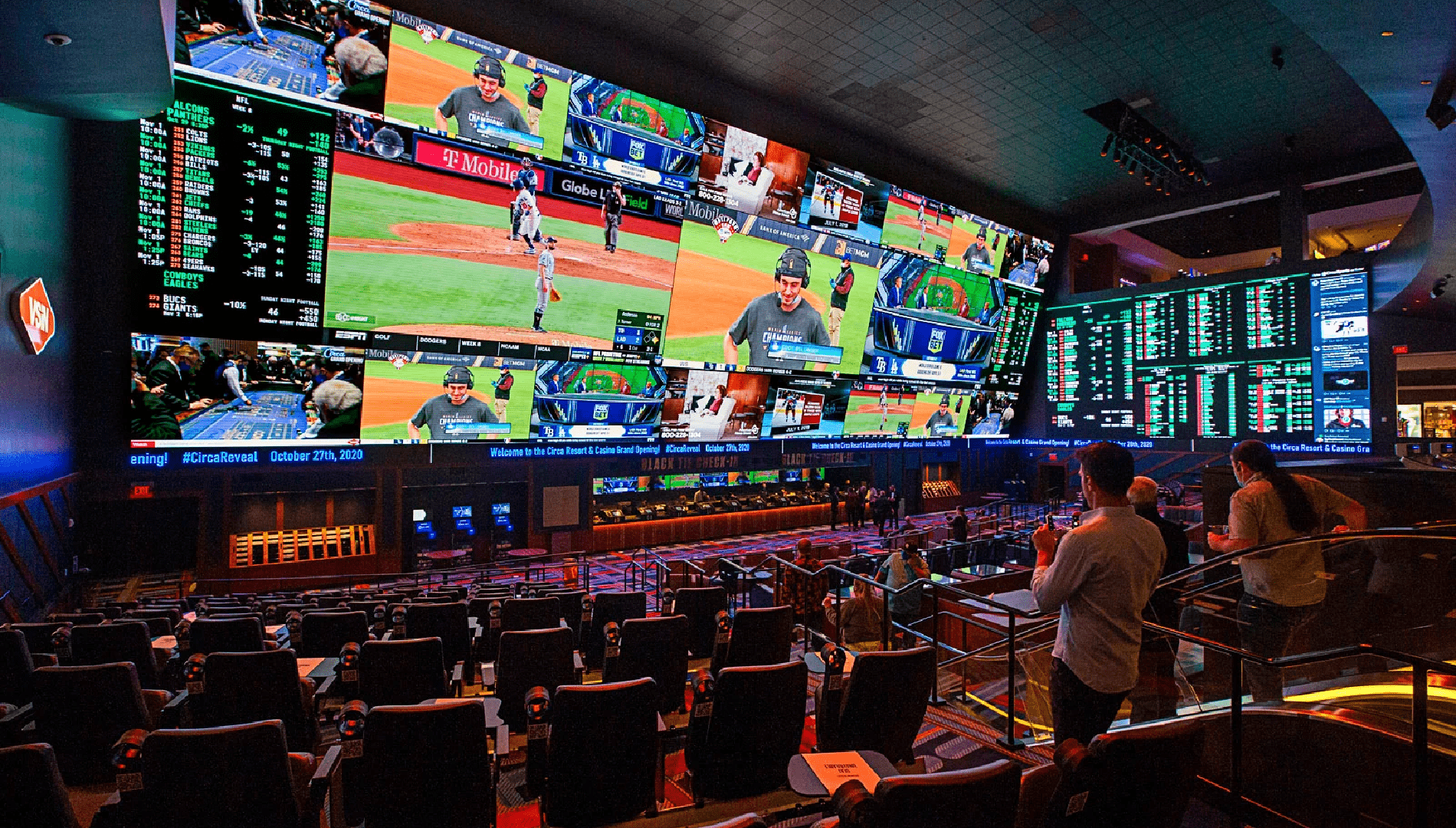

Nevada In-Person Requirement Hampering Sports Betting Revenue

It was well known that Nevada will lose its monopoly on regulated sports betting in the US when the Supreme Court rendered its decision on the Professional and Amateur Sports Protection Act (PASPA) in 2018.

At the time, industry watchers were unaware of how severely restrictive laws would make Nevada a regional player and prevent the state from increasing its tax revenue from the sports betting boom. But that's precisely what's taking place. Nevada's in-person registration barrier is impeding the state's sports betting sector.

This implies that in order to open a mobile sports betting account, residents must physically visit a casino and complete the necessary documentation, and they must repeat this process for each account they wish to open. If a bettor wanted to use BetMGM, Caesars Sportsbook, and Circa Sports, they would have to visit three casinos to register for those applications.

"On its face, this seems like a minor annoyance for potential consumers, but that minor annoyance actually has a tangible impact on the local market,” wrote Michael Schaus, founder of Schaus Creative LLC, in an op-ed for The Nevada Independent.

He is correct. Sportsbook operators in Arizona booked more bets than their Nevada counterparts in April for the first time since online sports betting launched in that state, and the difference was significant at $87 million. Nevada sportsbooks received over $1.7 billion more wagers than their Arizona counterparts last year, but Arizona bookies made almost $77 million more, underscoring the benefits of mobile registration.

Nevada Regulations Produce Drawbacks

The industry has criticized Nevada's in-person registration restriction for mobile sports betting accounts, which has clear disadvantages.

For instance, residents in Las Vegas have to go to the Strip to open accounts with BetMGM, Caesars Sportsbook, SuperBook, and other companies, even if they frequently detest going there. The only sports betting apps available to residents who don't want to visit the Strip or downtown are those offered by Boyd Gaming and Red Rock Resorts.

The difference between Nevada and Arizona is expected to widen until the latter does away with the in-person registration barrier; some analysts estimate that Arizona's annual revenue advantages over the Silver State might reach $100 million to $200 million. In other words, Nevada rules are costing the state money, and Arizona is functioning in the twenty-first century.

“And while that might be frustrating for consumers, and a bit puzzling for tourists, it also means Nevada operators and state coffers are missing out on their share of the online gaming gold rush taking place in markets all around us,” added Schaus.

Big Players Are Not Allowed to Attend Nevada In-Person Regs

The two biggest online sportsbook companies, FanDuel and DraftKings, have likewise remained outside of Nevada due to the state's need for in-person registration. There has long been speculation about when that would change, and such businesses have options, such as possibly purchasing land-based casinos.

However, because DraftKings and FanDuel have bigger betting menus than Sin City-based bookmakers, some professional sports gamblers in the Las Vegas area may go near the Arizona border to access them, suggesting that Southern Nevada sportsbooks lack geographic moats.

Because Oregon is home to a DraftKings monopoly and only makes up a small portion of Nevada's population, Nevada has some geographic advantages over its neighboring states of California, Idaho, and Utah, which all forbid sports betting.

UK

UK