High Roller Technologies Cuts IPO Size by 26%

High Roller Technologies, an iGaming operator based in Las Vegas, reduced the scale of its planned initial public offering (IPO).

In a revised Form S-1 filing with the Securities and Exchange Commission (SEC) issued on Thursday, High Roller announced its intention to offer 1.3 million shares at an indicated price of $8. Earlier, the firm stated it would offer 1.5 million shares priced between $8 and $10. The updated IPO conditions suggest the shares will launch with a market capitalization of $68 million. High Roller anticipates generating $10 million in revenue from the offering, which is 26% lower than earlier projections.

"The company is an evolving and growth-oriented online iCasino operator of business to consumer brands, leveraging its online operational and marketing expertise and assets as the foundation for what we believe to be a highly competitive growth model. We believe that the combination of our digital intellectual property, commercial partnerships, operational expertise of our management team, and customer-centric approach that fosters loyalty are among our competitive strength,” according to the SEC filing.

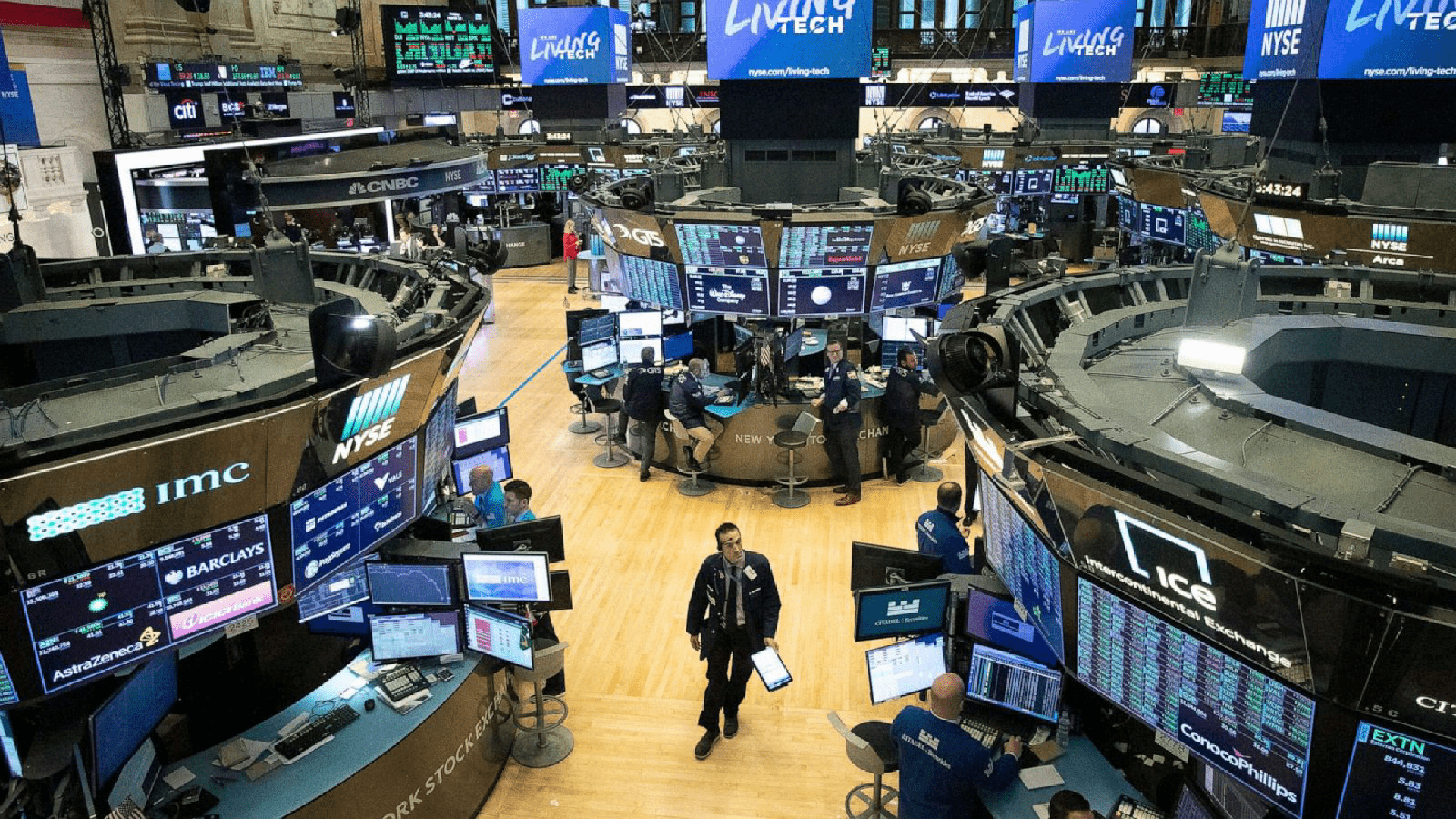

ThinkEquity continues to be the exclusive bookrunner for the IPO. High Roller intends to become publicly traded on the New York Stock Exchange (NYSE) with the ticker symbol “ROLR.”

Limited Information on High Roller Technologies' Decision

High Roller did not reveal reasons for its decision to reduce the size of its IPO, nor did it provide specific insights regarding the condition of the rapidly expanding iGaming sector.

There are several reasons that firms in all sectors lower IPO prices, and not all of them are unfavorable. The IPO price may be lowered if underwriters misjudged market demand, or it could be decreased to stimulate interest among investors, prompting them to invest in a new company.

That's a tactic commonly employed by emerging growth firms, including High Roller. There is also a degree of risk with High Roller, as noted by the company in the S-1, since it relies significantly on Spike Up Media for leads.

“Approximately 29% and 78% of our leads were generated by Spike Up Media during 2023 and 2022, respectively. We plan to continue mitigating this dependency through internal staffing and by working with other lead generators. Our initial payment arrangements with Spike Up Media for lead generation were at favorable rates to us resulting in more rapid payback of customer acquisition costs than we might otherwise expect from leads generated by other unaffiliated providers,” according to the regulatory filing.

Additional Information on High Roller Technologies

High Roller’s IPO may experience significant demand since online casinos are generally perceived as the long-term growth driver in the gaming sector, as this type of wagering provides greater margins compared to land-based casinos or sports betting.

The iGaming investment thesis faced challenges in the US this year as no additional states sanctioned that type of betting, maintaining the total at six. An increasing number of jurisdictions embracing internet casinos could be advantageous for High Roller.

“High Roller Technologies is an online gaming operator that offers a real money online casino platform. Its platform is based around a set of gaming products, which it refers to as ‘iCasino’ and is offered to players in select markets throughout the world,” noted IPO research firm Renaissance Capital. “It currently offers more than 3,000 games, including video slots, blackjack, roulette, baccarat, craps, and video poker, and its 50+ providers include names like Evolution Gaming and Pragmatic Play, among others.”

UK

UK